We hope everyone is as excited about the upcoming holiday season as we are at Platinum. Below is a reminder of some tax changes introduced in the provincial budget released April 7, 2021.

Provincial sales tax (PST) - Effective December 1, 2021, PST applies on:

- audio and video streaming services

- sale of taxable goods sold by third parties through online marketplaces

- booking of taxable accommodations through online platforms

Businesses providing these services, and facilitating these marketplaces and platforms for sales, to Manitoba consumers will be required to collect and remit PST, regardless of whether they have a physical presence in Manitoba. These new e-commerce measures are similar to those that have been, or will be, implemented by Alberta (online accommodation platforms only), British Columbia, Saskatchewan, Quebec and the federal government.

PST exemptions

Personal care services including hair salon services, non-medical skin care and aesthetician services, body modifications and spa services are exempt from PST, effective December 1, 2021. PST continues to apply to tanning services provided by a device that uses ultraviolet radiation.

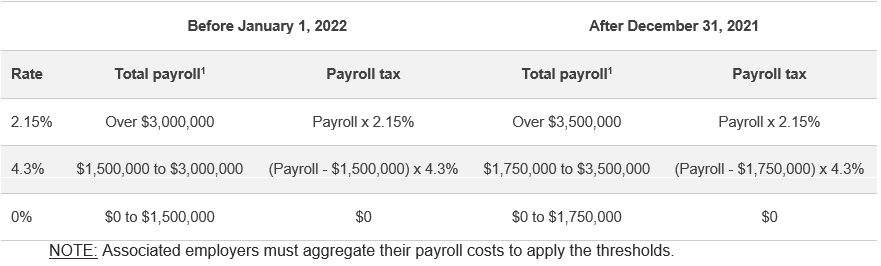

Health and Post-Secondary Education Tax Levy (payroll tax) - Effective January 1, 2022,

The thresholds at which employers are subject to this payroll tax will increase, as shown in the table below. The tax is imposed on wages paid by employers with a permanent establishment in the province. Associated employers with annual payroll of less than $3.5 million will save up to $10,750 in payroll tax annually.

Stay Healthy,

Greg Libbrecht and the team at Platinum Business Services